tv Nightly Business Report PBS November 26, 2012 7:00pm-7:30pm PST

7:00 pm

are online, and spending; they'll shell out an estimated $1.5 billion online today. >> susie: and change comes to the nation's top securities regulator: mary schapiro is stepping down. we look at what's next for the securities and exchange commission, and its new leader. >> tom: that and more tonight on "n.b.r."! >> susie: americans were back at work today after a long holiday weekend, but returned to the same worries about the fiscal cliff. and a new report from the white house added to the worries, showing that unless there's a deal on solving the crisis, the u.s. economy would suffer big time. the obama administration's economists estimate consumers would spend about $200 billion less next year than they would have otherwise. congress and the administration have only a few more weeks to nail down a deal. but that deal will have to address some tough issues, including entitlement reform. darren gersh explains. >> reporter: the big money in entitlements is in health care,

7:01 pm

and that means any grand bargain to avoid the fiscal cliff will slice away at one of the nation's most popular programs. >> medicare is clearly in the gunsights. >> reporter: it's possible congress and the president could agree to save $300 to $400 billion from medicare by cutting fees for doctors and hospitals. but analysts worry slashing payments won't make the health care system more efficient. >> this is not really a way to structurally change medicare and if you don't change the underlying incentives, you don't get long-term savings. >> reporter: progressives at the center for american progress say the government could save close to $150 billion by squeezing the prices the government pays for drugs. but many of the president's allies reject the idea of aggressively raising co-payments for patients. and they also consider benefits based on a patient's financial situation a risky idea. >> if people want to ask the wealthy to pay more, the time to ask them to pay more is when

7:02 pm

they can afford it, which is to say when they are working, not when they are retired. so they way to do that is to ask them to pay a little bit more in taxes. >> reporter: the president and congressional leaders are unlikely to raise the retirement age for medicare to 67 since polls show that's very unpopular. and they will try to minimize opposition to any other changes they make. >> i think a pretty small share of the spending savings will be actually structural reforms or things that could directly affect beneficiaries and those things will probably be slowly phased in. >> reporter: but without an agreement to trim entitlements, republicans say they won't raise taxes. and the white house says the president is not backing down. >> he will not sign an extension of the bush-era tax cuts for the top 2% because it's bad economic policy. >> reporter: the president's tax plans got some support from legendary investor warren buffett today. writing in the new york times, buffett says higher taxes won't lead the wealthy to go on strike and give up promising investment opportunities. darren gersh, "n.b.r.," washington.

7:03 pm

>> tom: talk of the fiscal cliff threat didn't seem to hurt cyber monday, the biggest online shopping day of the year. americans are expected to spend $1.5 billion online today according to research firm comscore. that's up 20% from last year, as retailers pull out all the stops to get shoppers to click on their websites. erika miller has more. >> reporter: many americans were hard at work today. but others were hardly working-- using high speed office computers to scour the internet for bargains. others browsed at retail stores, but used mobile phones and tablets to make their purchases online. >> but internet shopping is more than just price comparison this year. it's about going shopping with friends and family even when they're not there. >> it makes them feel better about shopping when they are accessing social media. and its sort of that gratifying that other people agree that this the kind of product that someone would like. it's a quality product. it performs well whatever.

7:04 pm

>> reporter: a whopping 122 million americans are expected to shop online today. retailers will be watching closely, trying to spot new trends and consumer preferences. >> the growth in retail-- a lot of it is coming from the online businesses. so we're really becoming cyber everything in terms of shopping. >> reporter: as of friday, nearly $14 billion has been spent online this holiday season. that's a 16% jump over last year. the fastest growing category for online spending is digital content like itunes. next is toys and consumer packaged goods, followed by video games and consumer electronics. and, while thanksgiving is a u.s. holiday, cyber monday goes beyond our borders: >> we are seeing that cyber monday is actually becoming a global phenomenon. and we've seen amazon launch canadian and uk cyber monday deals. we're seeing brazil and spain launch cyber monday deals.

7:05 pm

>> reporter: online shopping is growing faster than bricks and mortar retail, but keep in mind, it's still only about 10% of all u.s. holiday spending. erika miller, "n.b.r.," new york. >> susie: when you tally up the retail numbers so far, sales topped $59 billion over black friday weekend, a 13% increase from last year. consumers have many choices to do their holiday shopping this year. online, in stores, smartphones, tablets, and social media like facebook are all in play. what strategies are working, and where are the best deals this holiday season? that's where i started my conversation with thomas blischok. he's the chief retail strategist at booz and company. >> well, shoppers this year actually have prepared more than they've ever seen in the past. a lot of preparation on-line before they get to the store. they're actually standing in line, on-line, they're looking, searching,

7:06 pm

showrooming, we call it, making a decision to buy and then either buying or moving on to on-line again. it is a fully integrated strategy. >> susie: tomorrow, we are here in a rebecca taylor store in manhattan and are you saying this say good example of a successful retail never tow's mar at the time-- marketplace, tell us why. >> this is a great store. they have a tremendous in store experience. so when you shop in the stores you get a chance to actually feel design and they are a fashion retailer. they also have a tremendous on-line presence. so in the next few years one of the differentiaters between winners and losers will be this issue of multichannel retailing. on-line matching the in-store experience. these guy does it really well. >> susie: you were tell approximating me that thises with a strong start to the holiday shopping season. so what do retailers and marketers have to do over the next couple of weeks between now and christmastime. so that this momentum is not lost. >> well, what's very important is that 101 million households are value seeking households. what is so important about

7:07 pm

that is retailers must continue to show value to the shopper if they have them coming into the stores. >> do you think that having the stores open on thanksgiving evening helped. was it worth it? >> i think it was a marvelous ploy. you know, i saw this issue of the time--based sales, special products was absolutely remarkable. the stores were packed on thanksgiving. >> now you were in the stores, you have talked to a lot of people. what were they telling you? are they in the mood to spend? >> absolutely they were in the mood to spend. tremendous amount of community, lots of folks with their i pateds, tablets in their hand, lots of folks waiting in line to find great deals in the stores. lots of folks looking for that special point item for the holiday season. >> susie: so what are people buying and what aren't they buying. >> i saw a huge amount of large screen tvs go out the doors. that is what is remarkable. i also saw a lot of ipad, video games, toys were huge. towels, christmas towels were huge this year.

7:08 pm

>> susie: what about luxury items. >> you know what i saw people buying that one special luxury item so that special coach bag or special dress or special rebecca taylor item. i mean obviously i would say that. so what is so porn here is that people were actually splurging a little bit this holiday season. >> so given what you see this weekend what is your forecast for how retail sales are going to be this holiday season? >> i still have a perceptio perception-- perception they will be lower than last year. we had a great four days. we will have a great, great cybermonday. the next few weeks will be pretty critical. half of the spin the shopper has done this weekend is about 400 dollars. 300 more to am could. it will be a tough holiday season. a lot of competition. >> toming thank you so much. great talking with you. >> you have a great day and a nice shopping season, great holidays.

7:09 pm

>> tom: still ahead, tonight's word on the street: technology. james rogers joins us with three tech stocks to watch for 2013. while shoppers were focused on holiday shopping deals, in europe, finding a deal to release emergency aid for greece remains elusive. euro-zone finance ministers and the international monetary fund tried for a third time today to reach a deal with greece. the hitch is further austerity measures, and another potential hair-cut for investors who lent money to greece. on wall street it was a mixed session. the dow fell 42 points, but the nasdaq rose almost ten points, while the s&p fell three. >> susie: a changing of the

7:10 pm

>> susie: a changing of the guard is coming to the securities and exchange commission. chairman mary schapiro announced today she will step down on december 14. the white house quickly named s.e.c. commissioner elisse walter as her replacement. sylvia hall reports. >> reporter: chairman mary schapiro took over the s.e.c. in january 2009, at the height of the financial crisis. since then, she's overhauled the agency and beefed up its enforcement arm. she's also overseen a large number of changes to the financial industry, ironing out many of the regulations in dodd- frank financial reform. about a quarter of the law's new rules from s.e.c. remain incomplete. though critics say she wasn't forceful enough against wall street executives, president obama today praised her leadership. saying quote, "...the s.e.c. is stronger and our financial system is safer and better able to serve the american people--

7:11 pm

thanks in large part to mary's hard work." >> reporter: the president's choice to replace shapiro, elisse walter would finish the 13 months left on the current term as chairman. walter served as interim chairman before shapiro took over. the administration has until next december to nominate a new chairman for a full term. sylvia hall, "n.b.r.," washington. >> susie: joining us now with more on the s.e.c., john coffee, securities law professor at columbia university. you know, jack, mary schapiro got lots of criticism for her years at the sec, whether you want to talk about lax supervision for the whole persony maddoff scandal, she gets criticized for it. as she leaves the sec what kind of shape is that agency in? >> well, i think it is in improved shape. remember that no sec chair in the long history of that agency has ever faced a more difficult, more demanding or more thanksless job than she took on nearly four years ago. she was not responsible for

7:12 pm

bernie maddoff, he was before her time. but she took on an agency that was at his hor-- historic low point as far as people's respect and morale. she changed some of that. there was talk about disband the sec and merging it into a conglomeration of other agencies. i think only her political instincts and she si a very good judge of washington and how to broker a compromise, saved the agency from either being disbanded or even more likely being starved to death by low congressional funding. she was able to convince congress to give at least a subsistance budget to the sec. and it was not a time for major new policy initiative its during her leadership but that's largely because congress was essentially deregulation minded and didn't want major new policy initiatives. >> susie: let's talk about her replacement. you know he lease walker, do you think she is going to be able to put in other changes and be a better leader, perhaps, for the sec?

7:13 pm

>> well, that answer has two parts. first, elise walters is someone who is bright, hardworking, totally incorruptable, totally honest and has all the right instincts. and she's worked with mary schapiro for a number of years. she worked with mary at the self-regulatory body and at the commodities future trading commission. so i don't think they have divergent perspectives. i don't know that she has all the political instincts that mary schapiro clearly had. but the greatest danger right now at the sec is that we might get a chairman who is too closely connected to wall street and would cooperate what i will call wall street's desire to downsize dodd frank and turn the agency into a much smaller, less active body. and i don't think elise walters will cooperate with that. she is truly oriented to consumers. >> susie: what do you think her priorities should be? >> well, i think she's going to be forced to deal with the problem of money market

7:14 pm

funds. that's on their agenda. all the other financial regulators have agreed that there is an urgent problem here. the sec has been stalemated and that stalemate may not go away but it's going to be back on the sec's desk in about two months with proposals from a body called the financial stability oversight commission. that's going to be their biggest crisis. beyond that i think elise is going to have to look at the enforcement crisis. no one in the country out there is very satisfied with a degree to which the agency has not gone after high ranking executives. that's partly a problem of cost because the agency is underfunded but i think the agency is not focused enough on the need to generate deterrent. >> sometimes they are giving out parking tickets. >> susie: let me just jump in here because we have less than half a minute. investigator, you're talking about things that they have to restore. investigator confidence is an issue, things like the flash crash and this not

7:15 pm

really making wall street accountable for that financial crisis. so what be done to restore investigator confidence in a few words? >> in very few words, enforcement is one thing. the public wants to know that those who are culpable will be held accountable. i don't think that has really happened because the sec has been too focused on quick settlements. beyond that we've got to deal with systemic risk and the really deep structural vulnerabilities that are whether the floo things like money market funds. that is the short term agenda. but on the background the basic thing to say about elise is she is very oriented toward consumer protection and does believe in a restoring investor confidence. >> okay so, tall order. thank you so much, jack. john coffee, law professor at columbia university.

7:16 pm

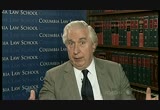

>> susie: new damage estimates today on super storm sandy. the insurance industry will be on the hook for as much as $22 billion, according to numbers compiled by disaster-modeling firm air worldwide. the total is three billion less than the original tally, issued just after hurricane sandy made landfall in late october. >> tom: it was back to work for wall street, with the major stock indices ending mixed. the selling was stronger earlier in the day, with the s&p 500 hitting its lowest level of the session before noon eastern time. the losses were reduced in afternoon trade with the index finishing down just 0.2%. trading volume remains modest. 630 million shares on the big board. a tad over 1.6 billion on the

7:17 pm

nasdaq. the selling pressure showed up in the telecommunication sector, falling 1%. the energy and consumer staples sectors also fell. with so much focus on consumers and spending over the weekend, grocery stocks led the consumer sector lower today. super markets safeway and whole foods were down 3.2% and 3.1% respectively. kraft foods fell 2.1%. kraft trades below the price it was at when it split off its snack foods operations. it was a mixed day for retail stocks despite generally positive returns for the big national chains over the weekend. macy's fell 4.5%. the stock hit a six month high last week in anticipation of the holiday season. nordstrom dropped 4.1%. volume more than doubled. both nordstrom and macy's were among the worst s&p 500 stocks today. after falling to more than a decade low last week, best buy

7:18 pm

bounced 6.7%. volume was heavy as traders pointed to short covering, when those betting the stock would fall have to buy to cover their positions. apple helped pull up the major indices in which it is included. the stock continues rebounding from its autumn sell-off. shares regained 3.1%, putting the stock at its highest price since the first of november. apple today asked a federal judge to add a half dozen more devices from competitor samsung to its patent infringement lawsuit as the two continue fighting in court. facebook shares also continued recovering, up 8.1% on heavy volume. this is a four month high after two wall street analysts upgraded their opinions of the stock expecting ad revenue to increase. the monday merger news was in the education industry. publisher mcgraw hill will sell its education business to private equity firm apollo global management. mcgraw hill originally wanted to spin off the business into a separate publicly traded company, but now it will sell it

7:19 pm

for $2.5 billion. news of the sale didn't move the stock much. while volume was heavy, shares gained just 0.4%. after the deal closes around the first of the year, mcgraw hill will be focused exclusively on financial services such as its s&p credit ratings agency. three of the five most actively traded exchange traded funds were up. the strongest was the nasdaq 100 tracking fund, up 0.4%. and that's tonight's "market focus."

7:20 pm

>> tom: tonight's word on the street: technology. 2013 is poised to see two big trends in technology continue: going mobile and big data. james rogers is a reporter with the street.com. >> james what are the conditions contributing to these trends continuing? >> well, we're seeing a lot of things happen and at the moment, no one there is a lot more smart phones being sold but also a lot more data being generated around the world. you know businesses are generating data, consumers are generating data so on-line retail, smart phone components and data storage are going to be big next year. >> this is the trio are you looking at for next year, beginning with amazon.com, the on-line retailing giant. increasingly though getting more content delivered and even device, can it grow into profit margins with its evolving business though? >> it's interesting. i mean the think it is still a compelling one for investors. it could really bode well for 20134. it has done a good job into

7:21 pm

tapping in the mobile boom and comparison shopping site it is good for consumers in a tough economy. i have to say yes, like many retailers amazon's profit margins are very thin. but you have to understand this is a company that spends a lot of money to actually grow its top line to grow its revenue. and from web services there say constantly evolving thin. and yet i do think it is a compelling story to 2013. >> talk to us about mobile phone, semiconductor maker call come i shouldn't say mobile phone. it's really smart phone chip maker qualcomm really it's made a name with the iphone devices. how much of its fate is tied to app snell. >> it's not just apple. you know obviously apple is the best known of the companies that qualcomm works with but it works with others as well. like samsung. i really like this, it is enjoying very, very good momentum. blue-- recently gave healthy guidance which is a stark contrast to other chipmakers and you think it is going to vb a big 2013. a lot of analysts are saying

7:22 pm

it is huge opportunity for qualcomm in emerging markets like china. also the next version of qualcomm, processor during the first quarter. >> tom: new products are always important and emc has several coming out if data storage but what about uncertainty surrounding corporate spending on technology for the data storage giant? >> well, you have to look he type of areas that emc plays in. it can be data and cloud which both still booming. also emc has a majority ownership stake in-- a data virtualization company that ed bos well. they have a lot of new products on deck for the coming months and i think that will be good news for the company's revenue growth. overall there is very positive wall street sentiment still around emc. >> three to watch next year. dow own any of this, james? >> no, none whatsoever. >> report we are thestreet.com, james rogers. >> susie: tomorrow on "n.b.r." we go down on the farm and look at getting the most bang for your buck when it comes to

7:23 pm

investing in farmland. and you've heard of black friday and cyber monday, now get ready for "giving tuesday". it's a new effort to boost charitable giving this holiday season. >> susie: that's "nightly business report" for monday, november 26. >> tom: goodnight susie, we'll see you online at: www.nbr.com and back here tomorrow night. captioning sponsored by wpbt captioned by media access group at wgbh access.wgbh.org

7:24 pm

7:29 pm

258 Views

IN COLLECTIONS

KQED (PBS) Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11